The Dow Jones Industrial Average (DJIA) dives lower today thanks to the data in the December Jobs Report. That report includes nonfarm payroll jobs increasing by 256,000 during the month, beating experts’ expectations. Alongside that is steady inflation over the last few months.

Stay Ahead of the Market:

While that’s good news for the economy as it staves off fears of a recession, it’s not the best news for the stock market. This report makes it less likely the Federal Reserve will cut interest rates in 2025, smashing investor morale today and hitting shares.

Shattered hopes of additional interest rate cuts caused a massive stock market downturn on Friday. That saw the Dow Jones fall 1.64% as of this writing, exacerbating what’s already been a rough few months with a three-month 0.53% drop.

Stocks Dropping the DJIA Index Today

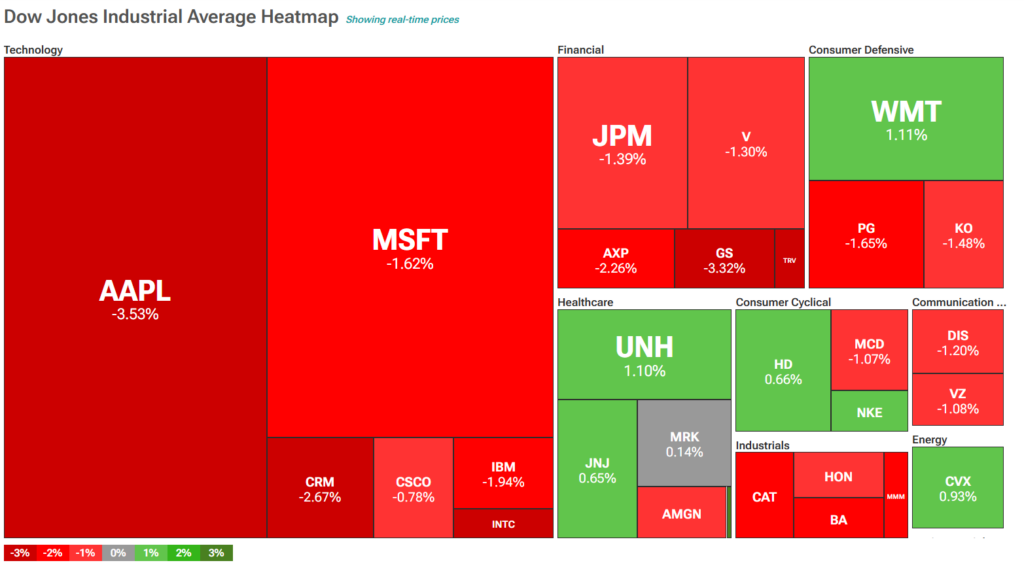

Turning to the TipRanks Dow Jones heatmap tool, traders can see which stocks are hitting the index today. The DJIA looks like a sea of red Friday with many of the biggest contributors to the index falling hard. However, there are a few green spots in the Healthcare, Consumer Cyclical, Consumer Defensive, and Energy sectors.

How to Invest in the Dow Jones?

Investors can’t take a direct stake in the Dow Jones as it’s only an index. Instead, they might consider buying shares of companies included in it. Tech stocks are significantly dropping today, making them a potential investment candidate before markets recover.

Traders could also buy stakes in exchange-traded funds that track the DJIA, including those betting on or against the index. One popular option among investors is the SPDR Dow Jones Industrial Average ETF Trust (DIA) but there are a variety of ETFs to choose from.

See more Dow Jones ETFs